Here is one of a conversation between myself (as a Financial Advisor) and my client Mr. I (an investor).

Me – “Now when we are clear about your financial goals in terms of how much you need when, let’s start towards execution”.

Mr. I – “Yeah. Let’s start it from next month”.

Me (After a month) – “As per our plan, we are supposed to start investment from this month. We will be investing 40K / month in Equity Mutual Funds for your long-term goals.”

Mr. I – “Is Equity investment safe? I have never invested before.”

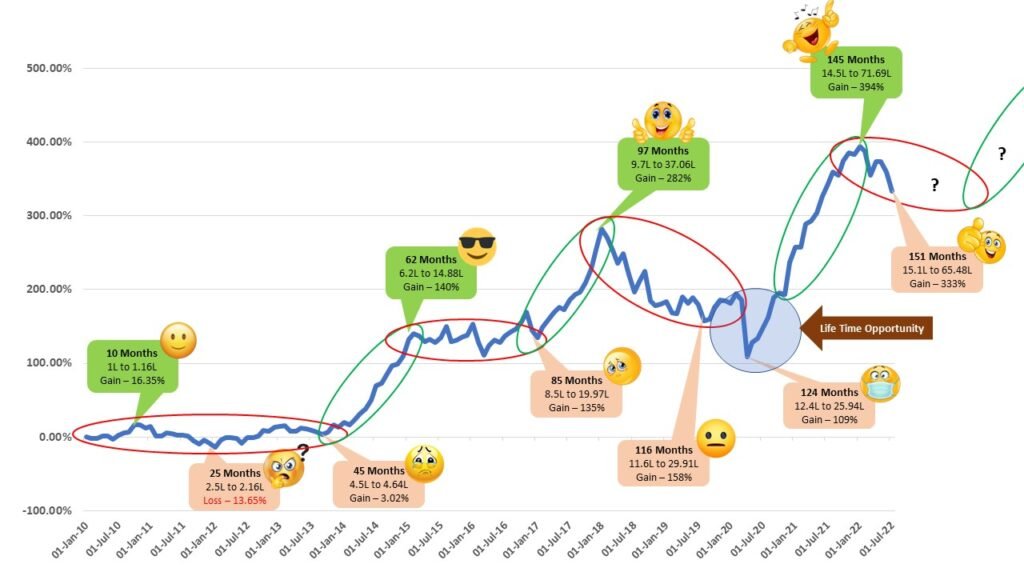

Me – “I would be wrong to say that Equity investment is not risky. There is definitely risk involved in the same, but the risk gets mitigated if you are investing for long term. It further gets reduced if you invest via SIP (Systematic Investment Plan)”.

Mr. I – “Let’s start it with 20K/month and once I get confidence, I will increase it by 20K after couple of years.”

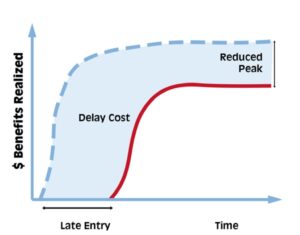

Me – “While I understand your concerns, I would still like to help you with a concept called COST OF DELAY and you can take decide post that”.

Mr. I – “What is that?”

Me – “In short, it is the cost or penalty one has to pay for delaying his/her investment decision. Let me try to explain you considering one of your goals in mind. You are planning to accumulate 80 Lakhs for Rudra’s graduation. (Rudra is Mr. I’s one year old son). For that I have suggested you start monthly SIP of 12K in Equity Mutual Fund. Now let’s assume that as you are not confident about the mutual fund investment, you start SIP of 6K and then after 2 years you increase it by 6K. With this, any idea on how much you would have accumulated in 17 years?”

Mr. I – “Definitely something less than what I would have if I would have started with 12K. If I calculate, I would have done lesser investment of 6K for 2 years which is 1.44L. With my understanding, I guess I would have accumulated approximately 2L lesser.”

Me (smiling) – “Wish the calculations were such straightforward.”

Mr. I – “Ok. If not 2L, then may be max 2.5L.”

Me – “You would have accumulated only 70.35L by delaying the SIP by 2 years. So overall, you would have accumulated 9.65L lesser and hence your cost of delay is 8.21L which is 9.65L – 1.44L.”

Mr. I – “Oh man!!!’

Me – “And in case if you still wanted to meet the 80L goal, the new SIP amount would have been 8K for all next 15 years. So, the cost of delay would be 3.6L which is 15 (years) X 12 (months) X 2K (additional SIP amount)”.

Ek lambi khamoshi… 🙂

Me – “Equity investment has a risk involved but the best risk mitigation strategy is giving time to your investment. Time is more than money when it comes to investing. Do not shy away from investing in equity and especially do not delay your investments. The COST OF DELAY.”

Mr. I – “IS TOO HIGH”.

Me (laughing) – “So, should we start with 20K?”.

Mr. I – “No. No. Let’s start with 40K. I cannot afford the cost of delay as it would be much higher with delaying investment of 20K per month”.

Me (shaking hands with Mr. I) – “Welcome to the World of Wealth Creation!!!”.

Disclaimer - Mutual Fund investment is subject to market risks. Please read the offer document carefully before investing. The rate of returns on mutual funds are not guaranteed. It is assumed @12% for the calculations purpose.