I am associated with financial sector for more than 12 years now. Often I see, when it comes to financial planning, people tend to focus on tax planning, investment and wealth creation. But as a result of this, they miss out on equally important aspect of it, which is Wealth Protection.

Risk Management is very important aspect of financial planning which can be done by having proper insurance, asset allocation, contingency planning etc.

We all know that we have different risks in our lives at different life stages. For example, while learning to ride the cycle we are at risk to fall. We avoid this risk by having side wheels to our cycle. By having an invertor we mitigate the risk of power failures. So in our day to day life we mitigate various risks by having an alternate or back up plan. We need to have same strategy when it comes to personal finance. Only when we witness events like Covid, natural disaster or any such unfortunate event, we get its seriousness.

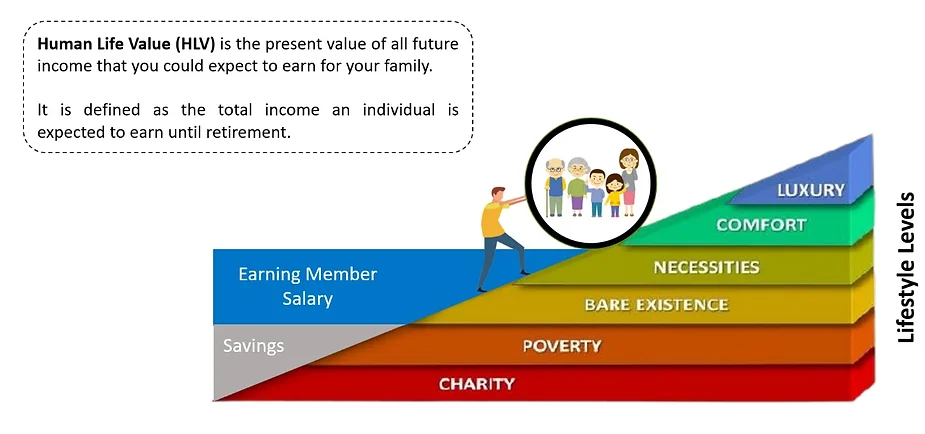

To fulfill our dreams, we not only depend on the current earning but also on the potential earning. If you are planning to build a corpus for your child’s education, you would need to save/invest for another 10 years. So, the plans/dreams/goals are dependent on the bread winner. Every earning member of the family has a Human Life Value (HLV) which is the present value of all the future income you could expect him/her to earn for the family.

With the earning the breadwinner has for the family, he/she is able to help his/her family live life at certain lifestyle level (as shown in the figure below).

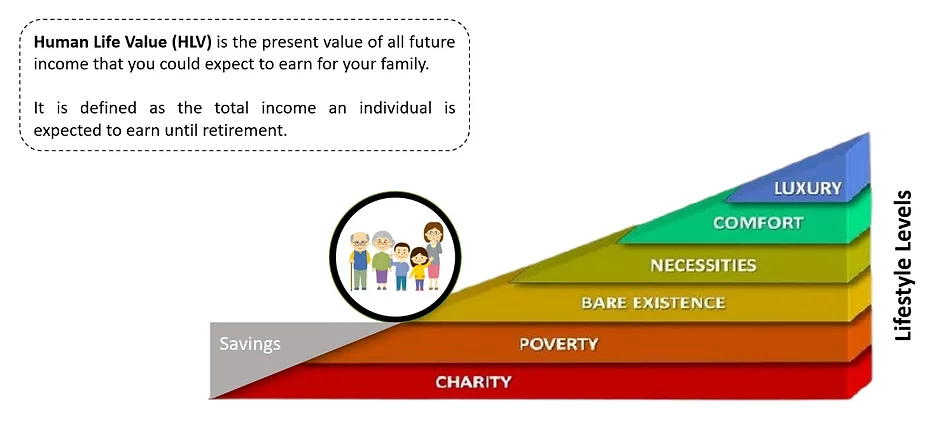

Now unfortunately if something happens to him/her, the family will have emotional and financial losses. Emotional loss is something which cannot be recovered by any means but if there are ways by which the financial losses can be made up. Life insurance is the best way to address these financial losses. In case of lack of life insurance, the family may have to compromise on their lifestyle as well as dreams (as shown below).

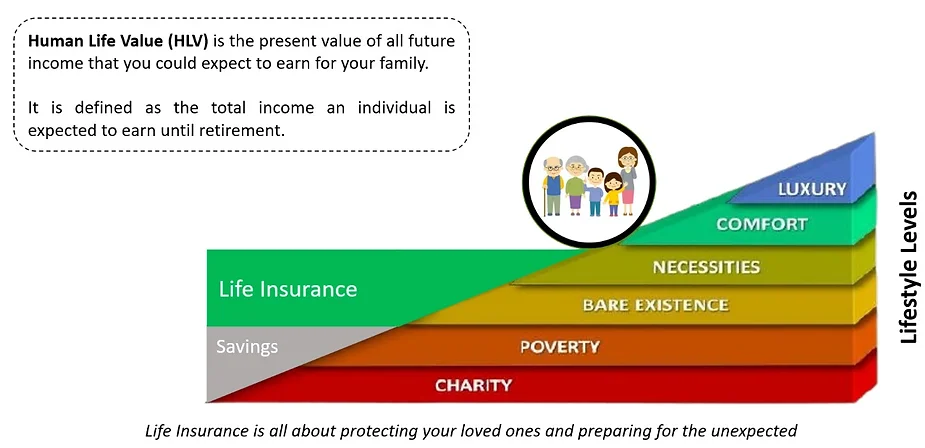

Life insurance actually helps to replace the HLV of the breadwinner to provide a financial platform to the family. This helps them to keep the same lifestyle as well as to fulfill the dreams they have seen (as shown below)

When it comes to life Insurance, Term Insurance is the purest form of life insurance.

Taking life insurance is nothing but a transfer of risk to insurance company which pays to recover the financial loss in case of unfortunate event like Death. There are thousands and lakhs of people who pay premium to insurance company. They are not at loss even if they have to pay one death claim as other people will pay the premium. But imagine the situation of family who have lost the breadwinner, they are 100% at loss.

Recommendation

Every individual should have these three polices from Risk Planning perspective.

1) Term insurance which cover risk of death

2) Health Insurance which covers the hospitalization and medical expenses

3) Personal Accident policy which covers the disability or loss of income due to an accident.